UNDP launches Insurance and Risk Finance Initiative for Nepal

This initiative seeks to prioritize financial resilience by tapping into the benefits of insurance and risk financing mechanisms, the UNDP Nepal stated in a press release.

KATHMANDU: The United Nations Development Programme (UNDP) Nepal has launched the Insurance and Risk Finance Initiative for Nepal.

It is part of UNDP’s global initiative, the Insurance and Risk Finance Facility (IRFF), which is being implemented in over thirty countries.

This initiative seeks to prioritize financial resilience by tapping into the benefits of insurance and risk financing mechanisms, the UNDP Nepal stated in a press release.

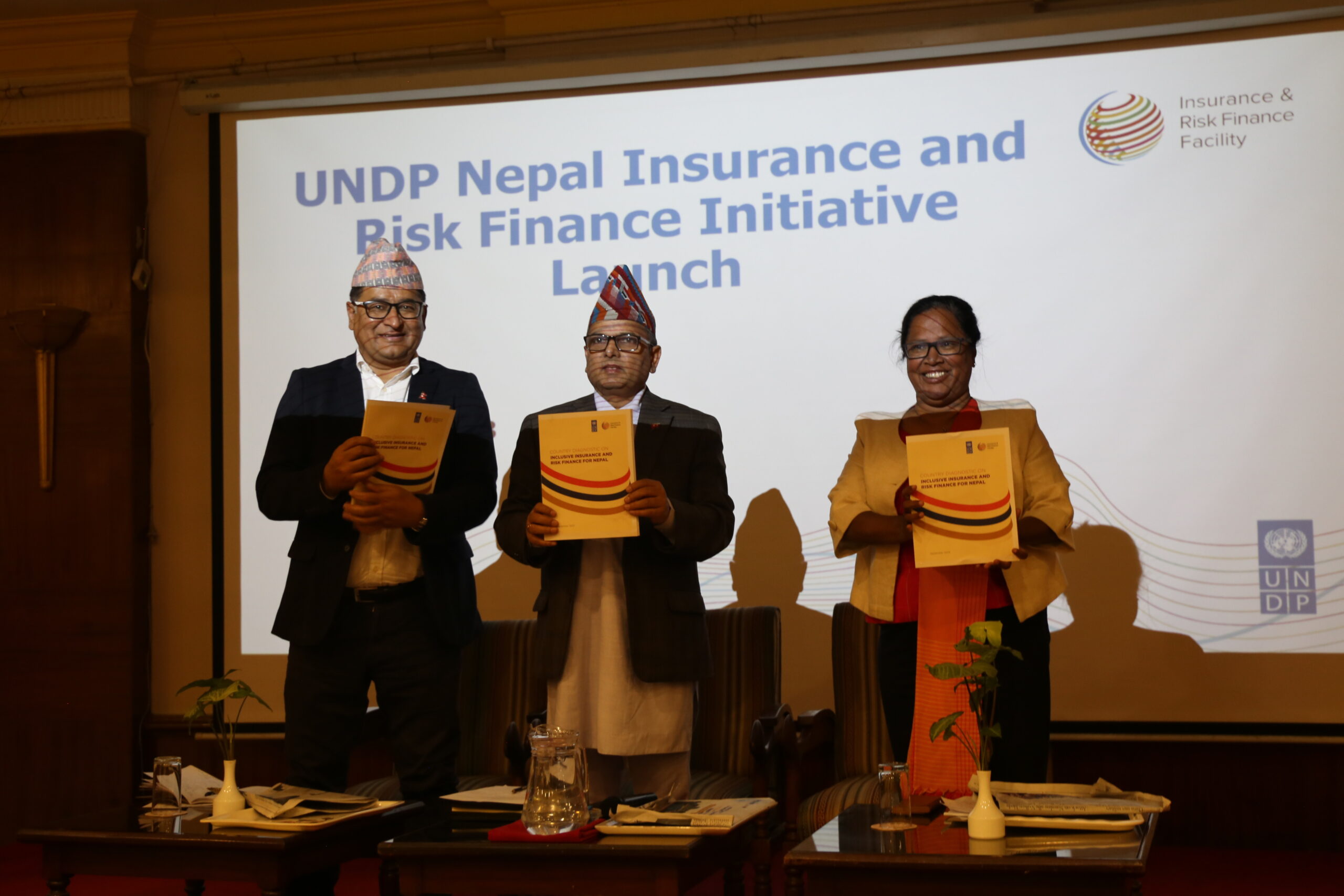

During the launching event on 19 March, the Country Diagnostic Report was unveiled by Dr. Ram Prasad Ghimire, Revenue Secretary of the Ministry of Finance (MoF), Anil Pokhrel, Chief Executive Officer of the National Disaster Risk Reduction and Management Authority (NDRRMA), and UNDP’s Resident Representative, Ms. Ayshanie Medagangoda-Labé.

The Report states that Nepal’s disaster landscape is impacted by earthquakes, floods, landslides, and droughts, which collectively have caused almost USD 7 billion in damages from 1980 to 2020. These disasters have affected the country’s capacity to build financial resilience in the face of looming disasters.

The Government of Nepal has spent NPR 50 billion (0.4 billion USD) between 2012 and 2020 in disaster response and recovery. The expenditure data indicates that this is not financially sustainable in the long run, which demands the development of risk transfer solutions.

The diagnostic highlighted that Nepal is one of the top ten countries most affected by climate change and is highly vulnerable to floods, landslides, earthquakes, and droughts.

The report also showcases that the Government of Nepal is committed to fostering the insurance industry’s ability to provide accessible and affordable insurance products, as evidenced by recent legal updates such as the Insurance Act 2079, which contains several microinsurance provisions.

While credit-life microinsurance and agriculture insurance offer financial protection to low-income and vulnerable Nepali households, the overall inclusive insurance market is still lagging due to low awareness about insurance and data gaps that prevent insurance companies from offering products that meet the needs of customers.

Dr. Ram Prasad Ghimire, Revenue Secretary at MoF, reiterated the government’s commitment to delivering risk finance solutions, mentioning that the government has already initiated the development of a Risk Management Framework.

Anil Pokharel, CEO of NDRRMA, highlighted the importance of collaboration between the government, development partners, and the private sector to address increasingly frequent and complex climate and disaster risks.

Meanwhile, Ms. Ayshanie Medagangoda-Labé, UNDP Resident Representative, stated, “Insurance and risk financing are among the solutions that can contribute to strengthening a comprehensive risk management approach for any country and community. We need to tap into the insurance market opportunities, leaving no one behind.”

The Initiative will work closely with government partners such as the Ministry of Finance, Nepal Insurance Authority and National Disaster Risk Reduction and Management Authority to improve legal and regulatory environment for insurance to be better incorporated in risk management priorities and actions.

It will also work with the insurance industry to identify the financial protection needs of vulnerable groups such as women, farmers and businesses and facilitate the offer of customer-centric insurance products. UNDP will work more broadly with other development actors also pushing for financial resilience to further advocate and make the case for insurance as a key ingredient in managing shocks and fast-tracking recovery.